Our impact

Our latest Outcomes Report outlines the impact of The Money Advice Trust’s activity across our advice services, training and influencing work.

Our Outcomes in 2023

Download our latest report

Helping people to tackle their debts

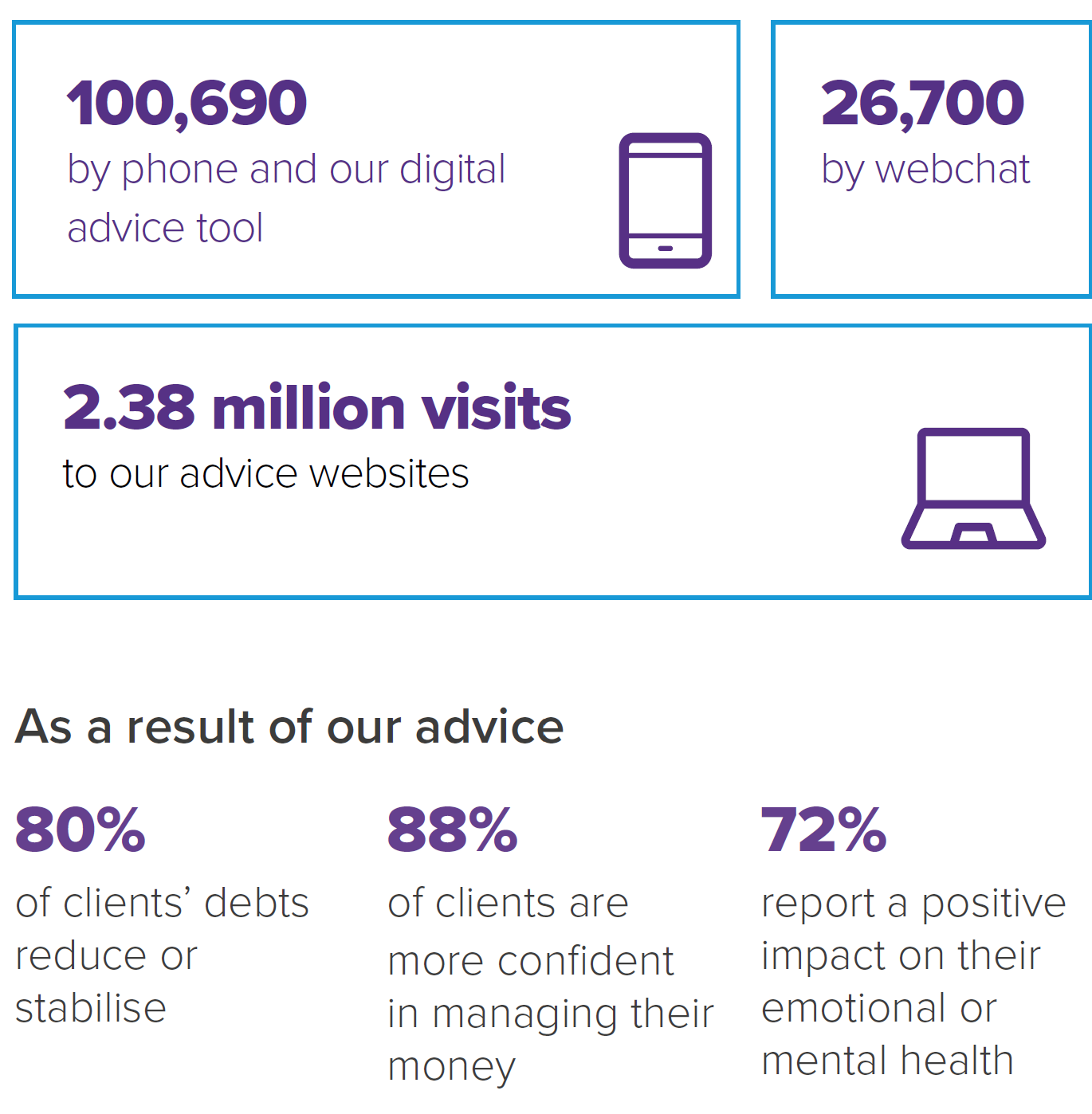

Last year at National Debtline and Business Debtline we helped 100,690 people on the phone and through our digital advice tool. We helped a further 26,700 people through our webchat service, and received 2.28 million visits to our debt advice websites.

Training the money advice sector

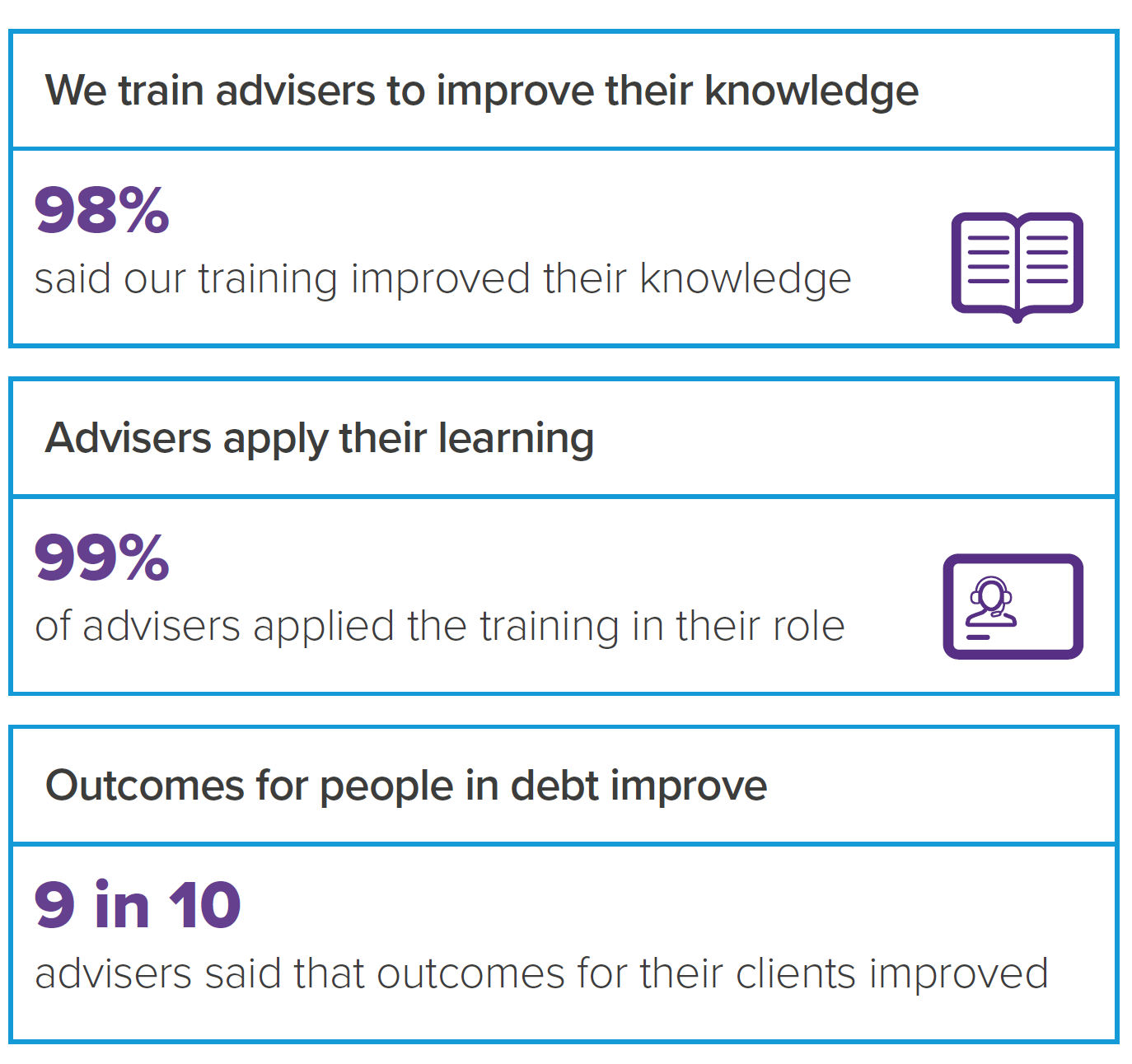

Last year, through our Wiseradviser service, we provided 20,180 training places to 2,710 advisers in 800 free-to-client agencies in the UK.

Improving support for vulnerable customers

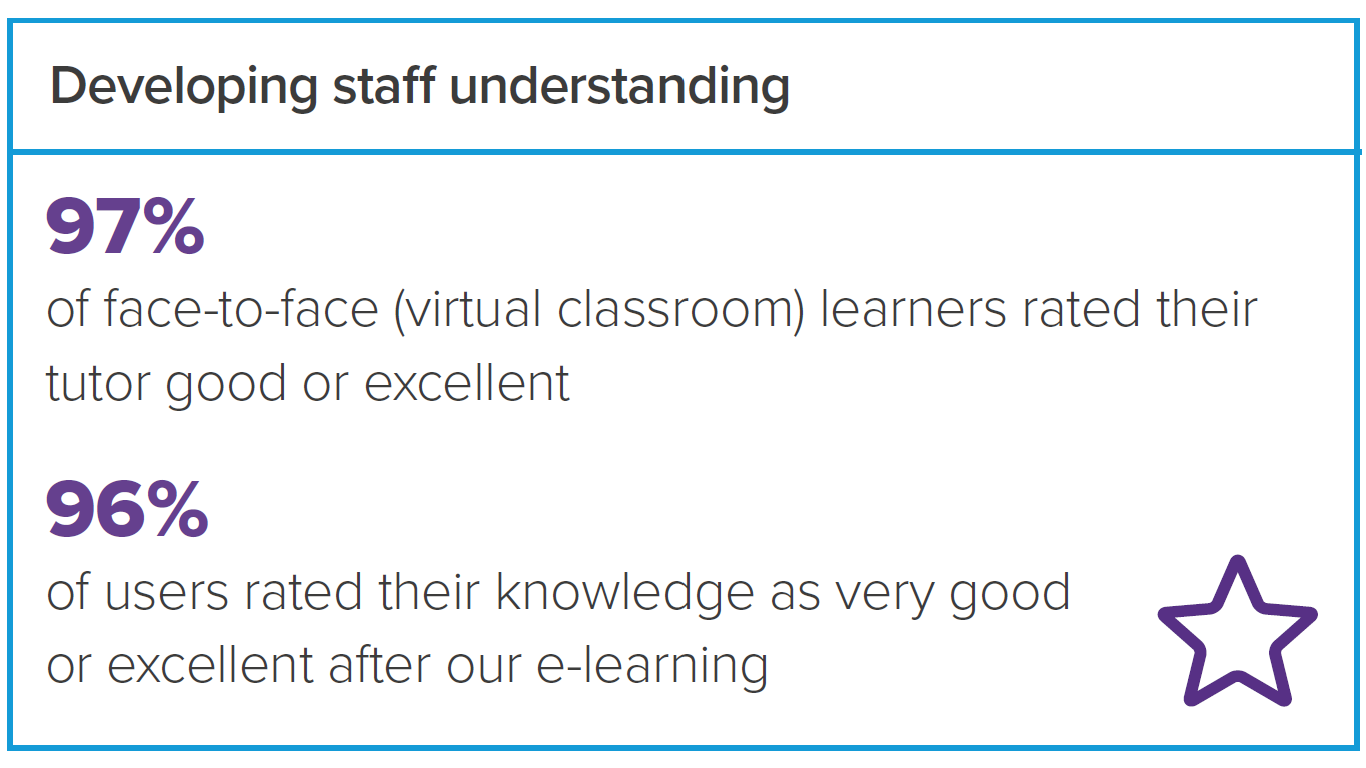

Our team of vulnerability experts work across a range of sectors, including financial services, water, energy and retail to improve policy and practice. In 2023, we delivered training to 6,000 staff in 70 creditor organisations to help organisations better identify, understand and support vulnerable customers.

Find out more about our vulnerability training and access our free resources: www.moneyadvicetrust.org/training-and-consultancy/vulnerability-resources/

Our approach to impact and theory of change

Our services put us in a unique position to understand why people fall into unmanageable debt and the challenges they face. Reviewing and evaluating the impact of our services is important to us. We use regular feedback from the people we help, across all our services and channels, to understand the impact we have and make improvements to our services. The framework we use to evaluate our impact is set out in our theory of change. This shows us how the Trust contributes to helping people across the UK to tackle their debts and manage their money with confidence.

It helps us to:

- show exactly how our work makes a difference; and

- demonstrate how our activities contribute to us achieving our overall vision.

Our high-level theory of change is as follows: