Advice services

We give free, independent debt advice to people across the UK through our telephone and online advice services. In 2020, our advisers provided help to over 160,000 people, and our advice websites had 1.9 million visits.

What you’ll find on this page: National Debtline, Business Debtline, How to deal with debt guides, Debt and Mental Health Evidence Form, and Referring to us

National Debtline

National Debtline provides free advice and resources to help people deal with their debts, over the phone, through our website and via webchat.

National Debtline adviser Dennis talks about

How we help our clients

Business Debtline

Business Debtline provides free advice to help you deal with your business finances and debts. You can access our services over the phone, through our website and via webchat.

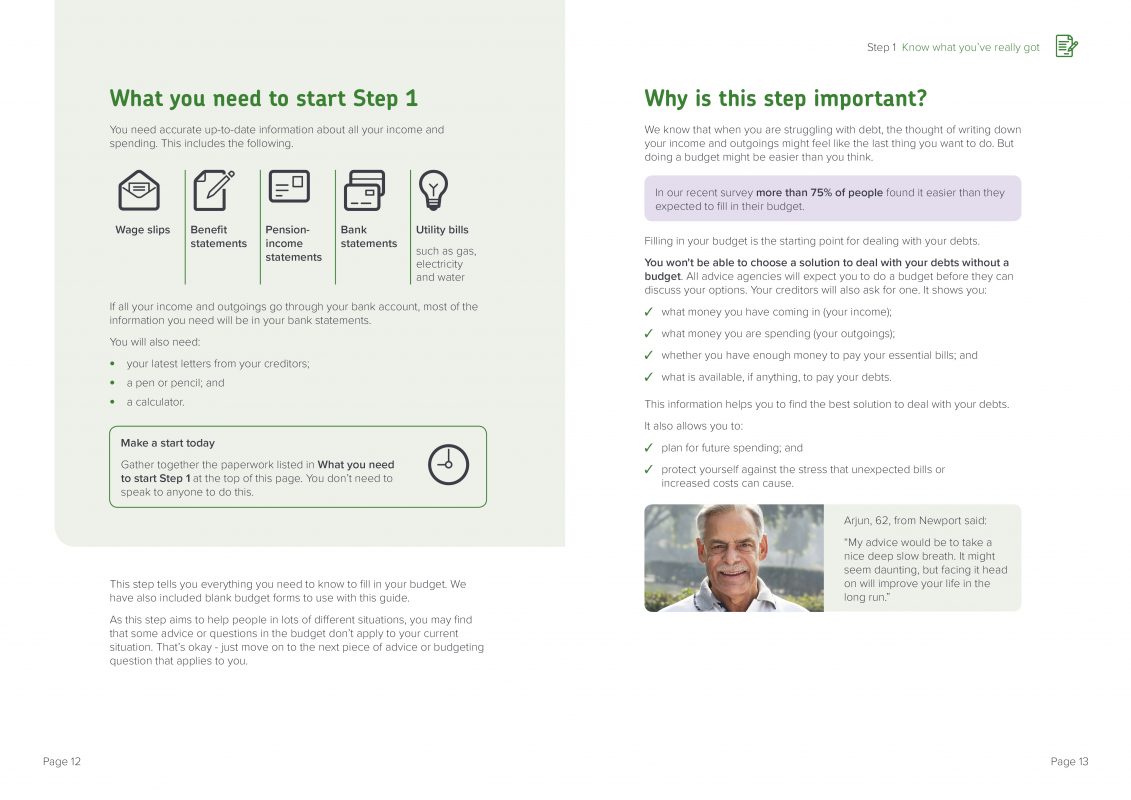

How to deal with debt guides

Our ‘How to deal with debt’ guide helps people take the steps they need to deal with their debts. Our England and Wales, Scotland, and Welsh language versions are available to order for free.

THE MAKING OF OUR

HOW TO DEAL WITH DEBT GUIDE

Debt and Mental Health Evidence Form

First launched in 2008, the Debt and Mental Health Evidence Form provides creditors with a way to collect external evidence about a customer’s mental health situation to decide what support to give to that customer.

“Getting to this point [launch of new DMHEF] has taken a lot of hard work from Money and Mental Health Policy Institute, Money Advice Liaison Group, Money Advice Trust, UK Finance, Credit Services Association, Department of Health and Social Care and others. But, importantly, this effort will hopefully make a practical difference to many people.”

Chris Fitch

Vulnerability Lead Consultant at the Money Advice Trust.

Referring to us

We want our services to help as many people as possible. We offer a range of free materials to help signpost people to our services.