Our impact in 2022

Jane Tully explores the findings from the Money Advice Trust's latest Outcomes report.

Posted July 10, 2023

2022 continued a difficult period for millions of households, as inflation soared and the cost of living continued to rise. For many, the effect of these rising costs is still being felt now.

The impact on our clients at National Debtline and Business Debtline has been particularly acute.

In our latest Outcomes Report, we look at the difference our work made to people and small businesses in financial difficulty and the challenges many continue to face.

Ongoing challenges

Many of our Business Debtline clients entered this period of higher costs still reeling from the financial impacts of Covid – last year “coronavirus” consistently led as the main reason for financial difficulty most commonly cited by Business Debtline clients (23%).

Across both National Debtline and Business Debtline, household budgets are struggling to keep up with increasing costs – 41% of National Debtline and 56% of Business Debtline clients do not have enough coming in to cover their essential needs.

Cost of living pressures often make difficult situations worse. Last year, the average budget shortfall amongst callers to National Debtline increased from -£308 in 2021 to -£393 in 2022. For Business Debtline clients, the average shortfall increased from -£460 to -£574 in 2022.

This week we published our latest Outcomes report, highlighting how our services made a difference in 2022.

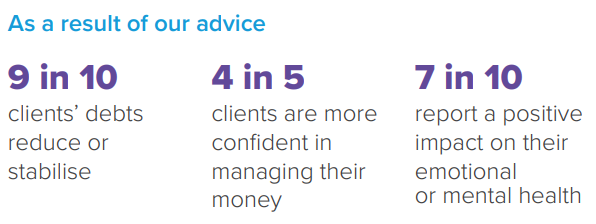

The impact of debt advice

Supporting our clients is central to what we do, and our National Debtline and Business Debtline services continued to provide a vital lifeline for struggling households and small businesses.

Last year our advisers helped 140,980 individuals and small businesses to tackle their debts. Our National Debtline and Business Debtline websites, which feature budgeting tools, helpful factsheets on a range of topics and template letters for people to contact their creditors, received over 1.87million visits.

Debt advice has a vital role to play in supporting people facing financial difficulty, especially in times like these when the pressure on household budgets is high.

It’s incredibly rewarding to see the difference our advice makes to people who are struggling with debts – testament to the commitment our advisers show day in, day out.

As the challenges for households and small businesses remain, we continue to look for ways to improve our ability to meet the needs of the people we help. We started this year by announcing enhancements to our services– including offering telephone casework for the first time through our National Debtline Partnership, and Business Debtline acting as the Centre of Excellence for business debts.

Improving the debt landscape

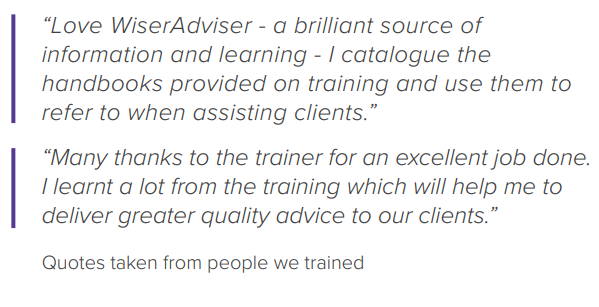

We continued to grow our training offer for advisers through Wiseradviser whilst expanding our work with creditors to improve support for customers in vulnerable circumstances. This work is crucial in improving support for clients and the wider money and credit environment.

Through Wiseradviser, we delivered 15,170 training places to more than 7,400 advisers across 2,780 organisations.

Nine in ten advisers we trained said the training helped improve outcomes for their clients and 97 percent felt better at helping people with their debt.

Our award-winning training and consultancy, which works with creditors, to improve how they identify and support customers in vulnerable circumstances, trained 5,260 staff in 68 creditor organisations.

We also expanded the number of public sessions we run, which cover subjects including, supporting customers living with addictions and inclusive design for essential services.

Improving the debt landscape

Influencing the conversation and policy around debt and the changes needed to improve outcomes for people in financial difficulty is an important part of what we do.

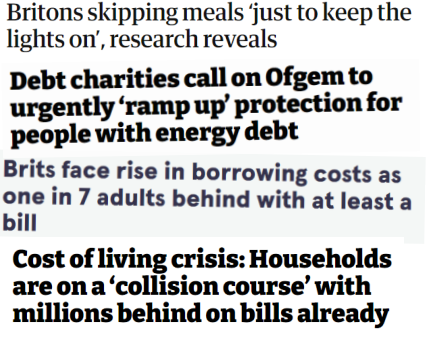

The cost of living rightly featured highly on the political and policy agenda last year, and our Collision Course and Impossible Choices reports tracked the impact that it had on UK households and small businesses.

Joining forces with other charities and organisations, we were also able to help drive support for people caught at the sharp end of rising prices through the uprating of benefits to keep up with inflation, and support for households struggling with energy bills.

Our influencing work also helped bring about progress on improvements to debt options, and we continued our focus on raising awareness of the challenges our clients face.

This activity has continued into 2023. And with high costs compounding the pressure on households and small businesses, our work will play a vital role in helping people most affected.

Read our full Outcomes Report 2022

You can also keep up with all the latest news from the Trust, our research and reports, and blog posts about our work and the issues facing our clients.

Jane Tully is the Trust’s Acting Deputy Chief Executive and has served on the charity’s Senior Leadership Team since 2014. She leads our work on policy, communications, marketing and research. She previously worked for the Charity Finance Group, Charity Commission, NSPCC and local government. View all posts from Jane Tully.