Our impact in 2023

Our Acting Deputy Chief Executive, Jane Tully, explores the findings of our latest outcomes report.

Posted March 14, 2024

2023 was another busy year for the Trust, as our National Debtline and Business Debtline services provided a vital lifeline to many people and small businesses struggling with debt. Last year we helped 127,390 people in financial difficulty, including 100,690 over the phone and via our digital advice tool, as well as 26,700 by webchat. Our advice websites received 2.38 million visits.

Households under pressure

As basic costs remained high, and energy debt hit record levels, the cost-of-living remained very much at the forefront of our work making a difference to people and small businesses in debt.

Perhaps unsurprisingly, income being too low to cover essentials was the most common reason for financial difficulty amongst National Debtline clients (16%), closely followed by job loss or income shock (10%), and receipt of an unexpected bill (9%).

Not surprisingly, given the pressure on many household finances, the two most common priority debt types (debts that could make you homeless, leave you without essential services or have extra powers to recover the debt) amongst National Debtline clients were council tax (32%) and energy (30%).

And the majority (63%) of National Debtline clients said the cost of living had made their debt problems worse, with 36% turning to credit to plug the gaps in their finances – risking a further increase in debt to meet the cost of essentials. Overall, 52% of our clients report this type of debt.

Small businesses feeling the strain

Business owners and self-employed people were also feeling the strain in 2023. Many were still dealing with the legacy impacts of Covid on their businesses, having not recovered to their pre-covid financial situation but were also hit by high prices affecting both their personal and business finances.

Business failure was the most commonly cited reason for financial difficulty last year amongst Business Debtline clients (20%) closely followed by coronavirus (11%) which one in 10 clients cited as the driver of their debts.

Income tax was the most common priority debt type amongst Business Debtline clients (26%), but similarly to National Debtline clients, council tax (22%) and energy debts (21%) also featured highly.

With energy debt levels already reaching a record high in 2024, and council tax rises round the corner for millions of people, these pressures seem set to continue this year.

Making a difference in 2023

Being in debt can be an extremely stressful and overwhelming experience. Taking that vital first step to seek advice can feel like too big a leap. People experiencing financial difficulty often deal with it alone – our research shows by the end of last year one in six people in debt had not spoken to anyone about their situation.

However, seeking debt advice can make a real difference. In 2023. 9 in 10 clients we helped were clear on their next steps after speaking to our advisers, 88% were more confident in managing their money and 80% saw their debts reduce or stabilise as a result of our advice.

Investing in our services

In 2023 a key focus for us was ensuring people who need debt advice know how to access our support and building our ability to meet the growing need for our services.

This included investing in technology and improving the client journey. We launched a casework service in February with our partners, Citizens Advice and Mental Health UK’s Mental Health and Money Advice service, which provides telephone casework to National Debtline clients for the very first time.

And with Business Debtline, the UK Centre of Excellence for business debts, we launched our AdviserHub – a new online resource for money advisers to help their clients who are self-employed and to prepare them for calls with Business Debtline.

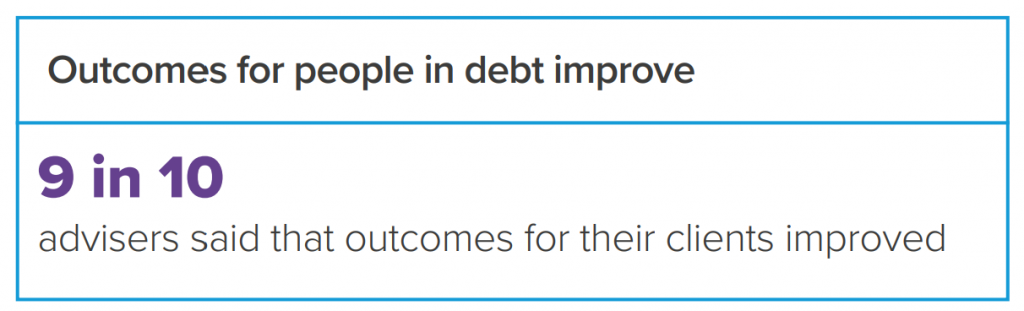

Improving outcomes for people in debt

In 2023 we delivered training to 6,000 front line staff in 70 creditor organisations to help them understand and support customers in vulnerable circumstances, including through the 10th cohort of our Vulnerability Academy in partnership with UK Finance.

We also provided 20,180 training places to 2,710 advisers in 800 free-to-client agencies across the England and Wales through Wiseradviser, which continues to play a vital role in training the debt advice sector.

Continuing our work to improve outcomes for people in debt more widely, we led calls for a Help to Repay scheme to help people struggling with energy arrears which is now being considered by government. We also helped embed best practice into the Government Debt Vulnerability Toolkit, in addition to responding to 21 policy consultations on a wide range of money and debt topics. This formed part of our wider work in highlighting the issues many of our clients face and seeking to improve the policy landscape for people and small businesses in financial difficulty.

Looking ahead

2024 is already looking to be another busy year for us here at the charity as our clients deal with the fall out of the cost-of-living crisis. Energy arrears have reached record levels, and with council tax increases around the corner for millions, as well as the ongoing impact of high costs, we will continue to do all we can to support people dealing with problem debt.

This includes reaching as many people experiencing financial difficulty as we can through our debt advice services, continuing our work training front line creditor staff and debt advisers across the UK, as well as working with partners from across the sector to improve outcomes more widely.

And finally, none of this would be possible without our many partners and funders, whose continued support enables us to carry out our work.

Read the Money Advice Trust's latest Outcomes Report.

Jane Tully is the Trust’s Acting Deputy Chief Executive and has served on the charity’s Senior Leadership Team since 2014. She leads our work on policy, communications, marketing and research. She previously worked for the Charity Finance Group, Charity Commission, NSPCC and local government. View all posts from Jane Tully.